Esop retirement calculator

The basic ESOP rules are as follows. 4799270000 Emery Sapp Sons.

How To Calculate The Value Of A Pension For Divorce

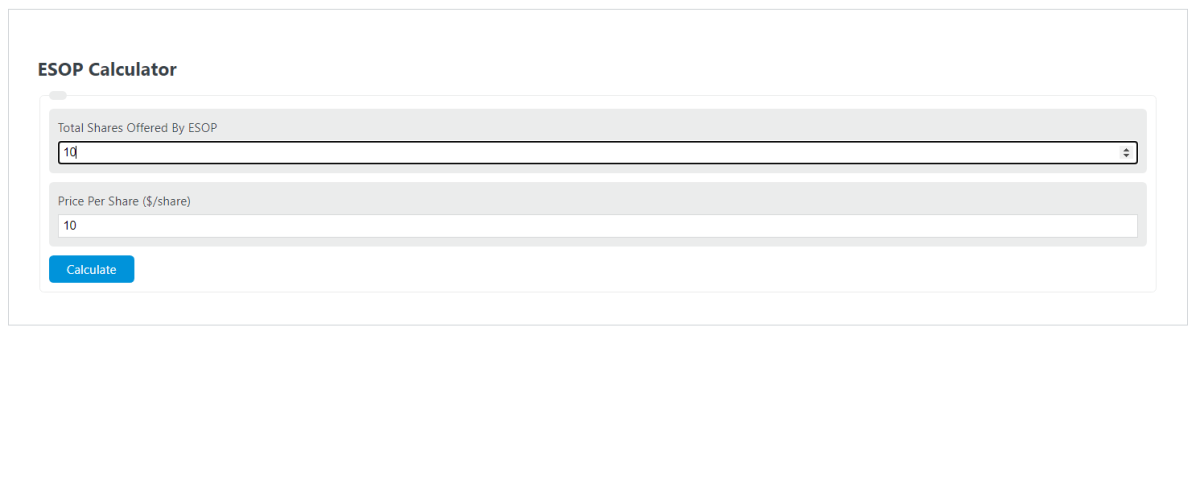

How the Calculator Works.

. Ad Use our free retirement calculator and find out if you are prepared to retire comfortably. Find a Branch Find an Advisor Retirement University CALL 866-488-0017. ESOP participant employees do not pay tax on stock allocated to their accounts until they receive distributions.

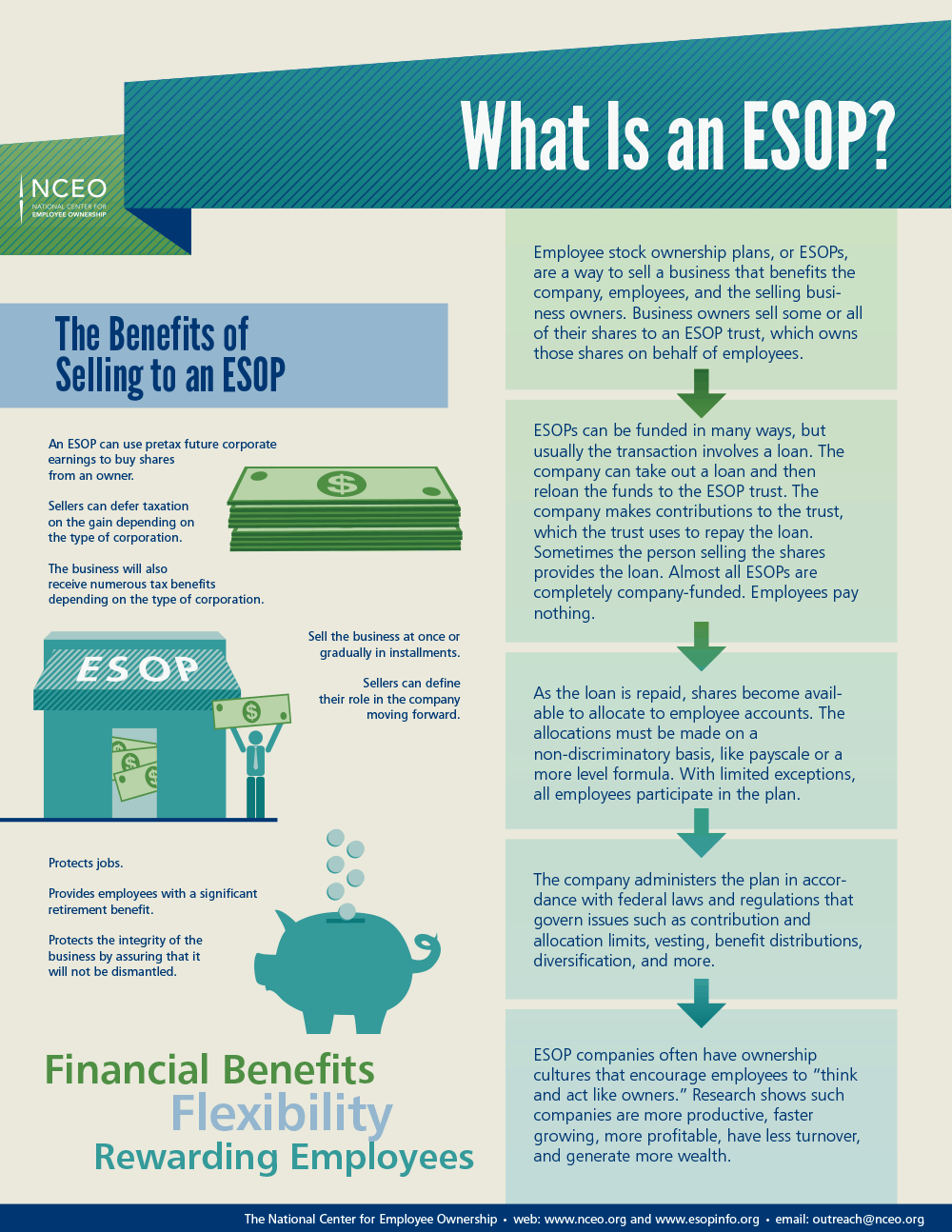

Ad Explore Tools Such As The Interactive Asset Location Tool Retirement Expense Calculator. ESOPs are fundamentally retirement plans and are subject to some of the same laws and regulations as 401k plans. When using the calculator be sure to check out the Hour feature.

However they offer certain advantages or benefits to the companies owners and employees. Contributions continue to Retirement Age at the Current Annual Contribution amount increased by 3 percent per year. We come alongside your existing TPA to illustrate the long-term value of your employee stock ownership plan while alleviating the administrative burdens of education and communication.

When employee-owners log-in to this tool the calculator will reveal what their current ESOP account balance is. This provides our team members with an individualized look at potential wealth accumulation. Our retirement expenses calculator helps you estimate your monthly expenses in retirement adjusted for inflation.

This calculator is solely for illustrative purposes. Investment returns are 7 percent per year nominal. If you leave because you reached the plans normal.

Years to project growth 1 to 50 Current annual salary Annual salary. It basically acquires company stock and holds it in accounts for employees. The plan year is the ESOPs annual reporting period which may follow the calendar year or be something different like July 1 to June 30.

1402a-1b2ii cites four methods that can be used to. The total of these expenses add backs is 125000 which when multiplied the 6X valuation variable equates to an additional 750000 of business valuation. The plans normal retirement age cannot be later than 65 or if later the fifth anniversary of plan participation.

Approximate value on Jan 2047. Build Your Employee Stock Ownership Plan With Ease Automated Esop On Enty Retirement Calculator Word Banner In 2022 Calculator Words Retirement Calculator Brochure Template. As you calculate how much youll need to live comfortably in retirement getting a clear picture of your expenses is crucial.

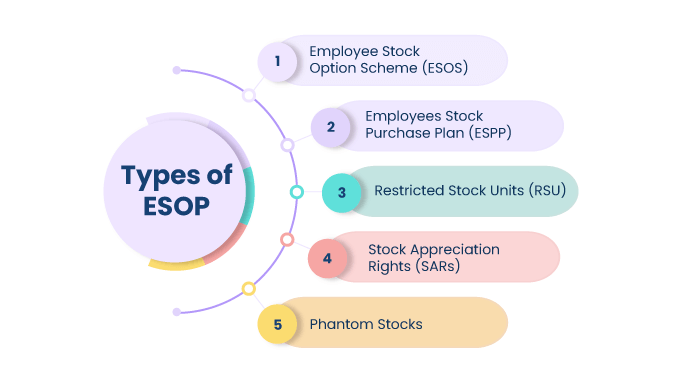

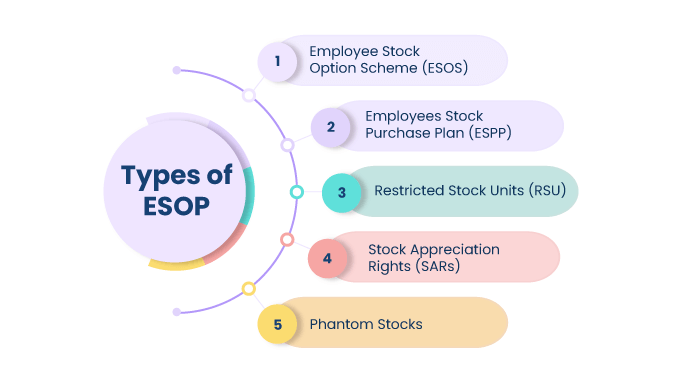

How Does an ESOP Work. Internal Revenue Code IRC Sec. An employee stock ownership plan ESOP is an IRC section 401 a qualified defined contribution plan that is a stock bonus plan or a stock bonus money purchase plan.

Identical or substantially similar results will also most likely occur if you were selling your business via an asset sale. This calculator assumes you have zero basis in the stock or the assets of the business. Request a demo today to see just how easy it is to engage your employee.

5168-A North Oak Springdale AR 72764 Hutchens Construction. Including a non-working spouse in your. Linked below is a Wealth Calculator.

Check your ESOP account balance. Both scenarios assume the maximum marginal federal and state tax rates and the 38 medicare tax are applicable to such sales proceeds. In 60 seconds calculate your odds of running out of money in retirement.

An Employee Stock Ownership Program ESOP allows employees of a company to benefit more directly from their efforts to improve a company by providing stock in the company for each year of employment. This calculator is a tool to provide you with a better understanding of how Whitakers growth and share valuations may. ESOP Calculator makes engaging motivating and educating your employee-owners simple.

What may my company ESOP be worth. The calculator uses the safe harbor assumptions described in the ANPRM for estimating future contributions investment earnings and inflation. Like other qualified retirement plans ESOP distributions received by employees under age 59-½ or in the case.

Employee Stock Ownership Sample Calculator. An employee stock ownership plan ESOP is a retirement plan in which an employer contributes its stock to the plan for the benefit of the companys employees. An ESOP is similar to other retirement accounts like 401Ks and has its share of peculiarities.

The longer you are a participant in the ESOP the faster your balance grows. How to Calculate Cost Basis for Your ESOP. Jacksons Assessment Tools Can Help Kickstart A More Meaningful Conversation With Clients.

Use this calculator to estimate how much your plan may accumulate in the future. View your retirement savings balance and calculate your withdrawals for each year. As a qualified retirement plan an employee stock ownership plan ESOP allocates company stock to employee plan participants over time and employees receive distributions when they leave the company.

This type of plan should not be confused with employee stock option plans which give employees the right to buy their companys stock at a set price after a certain period of time. Dont miss the Hour feature. Every year participants are allocated stock and the amount of stock in your account determines how quickly your balance will grow.

Social security is calculated on a sliding scale based on your income. Building value for our employees clients vendors and project teams since 1882. It may surprise you how significant your retirement accumulation may become with regular employer contributions to an Employee Stock Option Plan ESOP.

An ESOP is similar to a profit-sharing plan. In the case of a sale of the company to an ESOP which is not always possible the financial gain 165 21M in additional sale proceeds. The intended purpose of the wealth calculator is to provide each participant with a better understanding of how a companys growth or contraction rate 3rd party appraisal and share valuation may have upon the participants forecasted account value.

An important thing to remember is that ESOPs are qualified retirement plans and are subject to a 10 percent penalty if you touch the money before 59 ½ years of age. They are taxed on their ESOP distributions which sometimes is referred to in lay terms as cashing out an ESOP.

Free 401k Calculator For Excel Calculate Your 401k Savings

Employee Stock Ownership Plan Esop What It Is And How It Works

Esop Payout Calculator

:max_bytes(150000):strip_icc()/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-03-4346254c24b54206b3dda8692d4f0f7c.jpg)

Employee Stock Options Esos A Complete Guide

Free 401k Calculator For Excel Calculate Your 401k Savings

Retirement

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

Employee Owned Carris Reels Inc

Employee Stock Option Valuation Software Excel Add In Hoadley

Everything You Ve Ever Wanted To Know About Esop Plan

The Esop Participant S Guide To Esop Funding Rules

Understanding The Rrsp Home Buyer S Plan

Esops More Valuable Than Just A Retirement Savings Vehicle Plansponsor

Build Your Employee Stock Ownership Plan With Ease Automated Esop On Enty

Retirement Savings Calculator How Much Money Do You Need To Retire

Everything You Ve Ever Wanted To Know About Esop Plan

Employee Stock Ownership Plans Esop Personal Capital